Published , by Asif Khan

Published , by Asif Khan

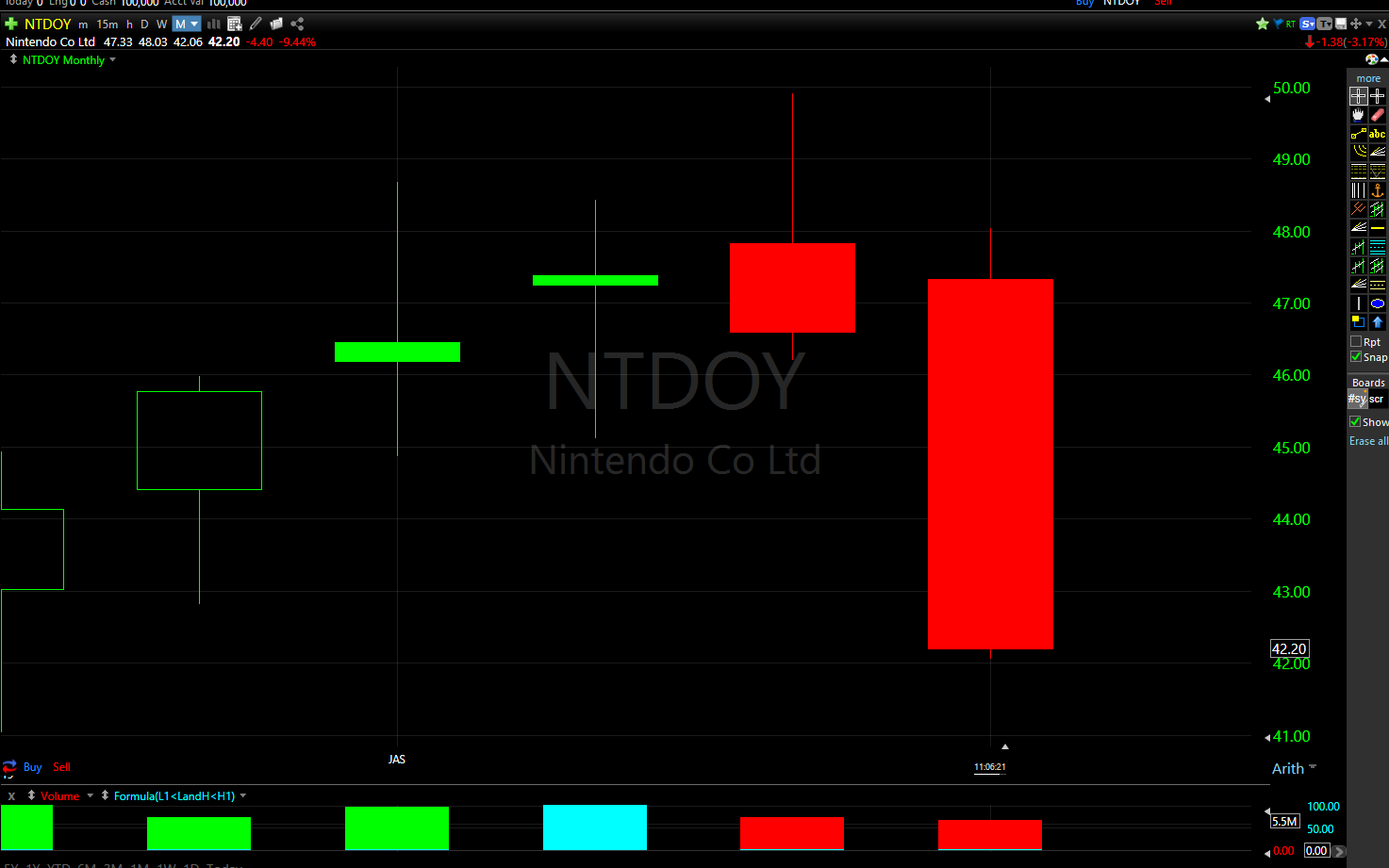

Hey Shackers! I wanted to provide an update on Nintendo, a stock that many readers of our Game Trader feature are interested in. The stock is down nearly 10% for the month of October. While there could very well be murmurs of a weak quarter in Japan and on Wall Street, I think it is important to look at all facets of investing in individual stocks.

We will find out the fundamental news when Nintendo releases their Six Months Earnings Release on October 31, but let's investigate the chart for any technical reasons why we could be seeing this selloff in NTDOY. Please take a look.

Nintendo's stock traded inside of it's July 2019 range in the month of August 2019. In September 2019. NTDOY traded up to $49.90/share only to close the month back within the August 2019 range. The bad news for Nintendo shareholders occurred in October 2019, as the stock broke down below September's low of $46.20/share. This is an active monthly reversal strategy sell signal that has about six days left to wreak havoc on shares of the Big N.

This is educational content and should not be considered as investment advice. Please consult a financial adviser and consider your own risk tolerance before making an investment decision. Keep an eye on Nintendo next week when they report their earnings results.

INSIDE BAR

A candlestick formation that occurs when the entire price range for a given security falls within the price range of the previous period.

OUTSIDE BAR

A candlestick formation that occurs when the entire price range for a given security is above and below of the price range of the previous period.

REVERSAL STRATEGY

A candlestick formation that occurs after an inside bar when a stock breaks above or below the previous period followed by a breakout of the range. It is essentially an equillibrium break followed by a reversal to the other direction.

For more information regarding the technical trading strategy that I use follow Rob Smith from T3 Live.

Find out more about the charting software used in this video at the Official TC2000 Website.

If you found any of the terms in the video confusing, please check out Investopedia for much more educational information.

Full Disclosure:

At the time of this article, Asif A. Khan, his family members, and his company Virtue LLC had the following positions:

Long Nintendo via NTDOY ADR